How to create a paystub document?

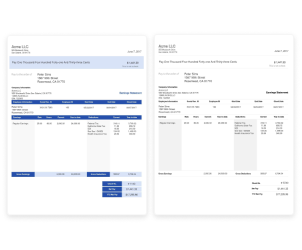

Our system streamlines the process by automating all calculations for both paystubs and forms. Just enter the required data, and our system will handle the rest, generating accurate documents. To ensure precision, we provide a preview feature allowing you to review the information before finalizing the documents.

How will I receive my paystubs/forms?

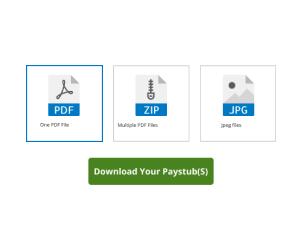

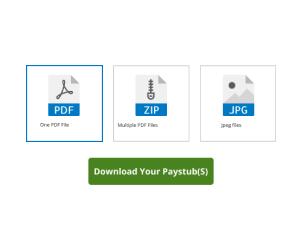

As soon as you complete your purchase, you can download your paystub(s) from your email. You can either receive the documents in a single PDF file that contains multiple pages, or you can choose to receive a zip file that either contains multiple PDF or JPEG files. In case you don't see the documents in your email's primary inbox, we recommend checking your Spam folder.

What if I am having issues printing my paystubs?

The PDF files we send are compatible with all printers and set to the standard US Letter format. They can be opened with any version of Adobe Acrobat Reader. To ensure smooth printing, please double-check your printer settings - the paper size should be set to 'Letter' and the scale should be set to 'Default'.

What should I do if my pay stubs are overlapping when I print them?

If your pay stubs are overlapping when printed, it might be due to selecting the wrong template. We advise you to utilize the preview option before downloading your stub. This will give you a chance to check and adjust any layout or formatting issues, helping to ensure your stubs print correctly.

How can I download each paystub separately?

When you reach the download page, simply select the 'Separate Paystub Files' option to receive each of your paystubs as separate files.

I have lost my paystub, can I re-download it?

You can always access your paystub via the email we sent or you can contact us and we will promptly send you another copy of your paystub.

How can I correct a mistake or edit my paystub?

If you need to make corrections or changes to your paystub, you don't need to place a new order. Instead, just get in touch with our customer service team and let us know the details that need to be corrected. Our committed team will swiftly make the necessary adjustments to your current order.

How can I create multiple stubs?

On the salary details page, input the pay dates sequentially, beginning with the latest date. By selecting the "Add Dates" feature, our platform will auto-generate preceding dates according to your chosen pay interval, working retrospectively. This functionality streamlines and enhances the accuracy of pay date input for crafting your stub.

Can I add a direct deposit slip to my paystub?

Absolutely, this feature is indeed provided. During the process of entering the necessary details for your paystub, you have the option of adding a direct deposit slip.

Is it possible to tailor the paystub template to my preferences?

Absolutely! We provide an array of templates, each with its own customization features, ensuring it aligns with your specific requirements. Find our templates

here.

Can I add my company logo to the paystub?

Of course! During the paystub creation process, you'll find an option to upload your company's logo, ensuring a tailor-made appearance.

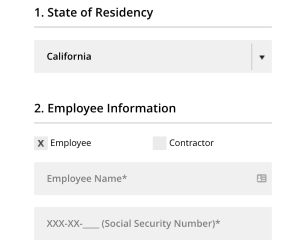

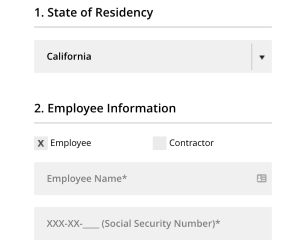

How can I generate pay stubs for my employees?

It's a simple process! First, in the employee information section, choose the employment status as "employee". Then, proceed to complete the essential fields, such as salary details. Once that's done, all the standard calculations and deductions relevant to your state will be processed automatically by our system. This ensures a quick and accurate pay stub creation for your employees.

What if my YTD is wrong?

Our system calculates the YTD automatically from January 1st of each year up to the most recent pay date. For instance, if your hiring date was January 1st, 2023, the system will consider your upcoming paychecks as the 15th and 16th of the year. If your employment started later in the year, please provide us with your actual hiring date or the number of paychecks you've received, and we'll adjust the calculations. If you already have a specific YTD amount in mind, share it with us, and we'll be glad to make the necessary corrections.