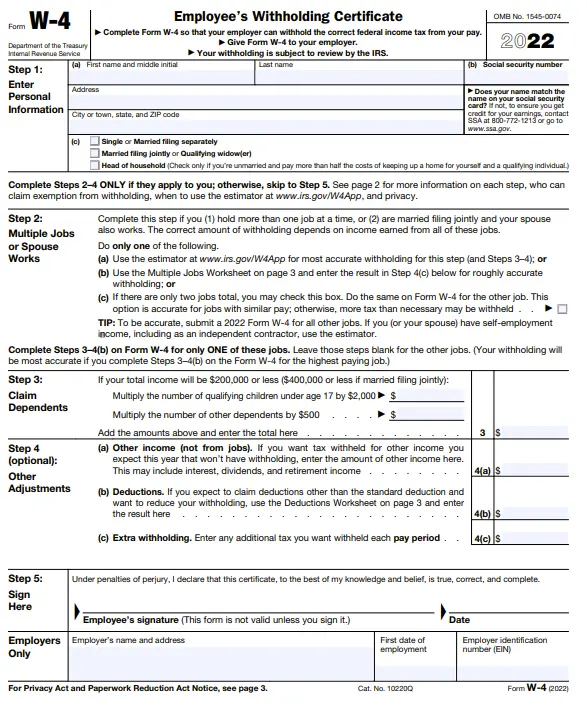

Step 1: Personal Information

The first section on the Form W-4 is the personal information section. Here, you will enter your first

name, middle initial, last name, address, social security number, and filing status. The information you

provide in this section is used by your employer to assign the federal income tax withheld by them to

your Internal Revenue Service (IRS) tax account.

It is important that your name matches exactly what is on file with the social security office. If you

have recently married and taken another last name, be sure to update your name with the social security

office.

Your filing status is a significant part of this first section. The amount of tax withheld by your

employer each paycheck depends on how you file your tax return. Assuming only your income from the one

employer, if you are a single taxpayer, you will have a higher tax liability than if you were a married

taxpayer with a spouse who does not also work. The standard deduction for married filing jointly is

double that of a single taxpayer, which reduces your taxable income on your tax return.

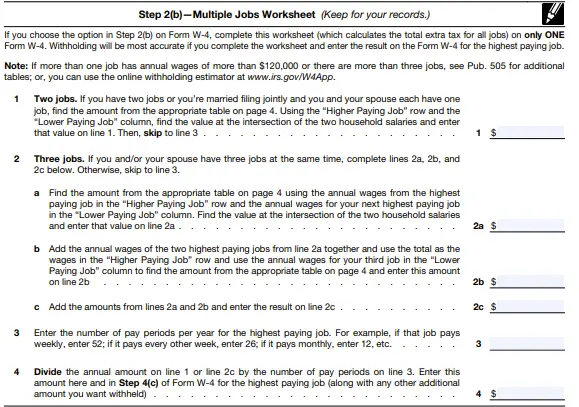

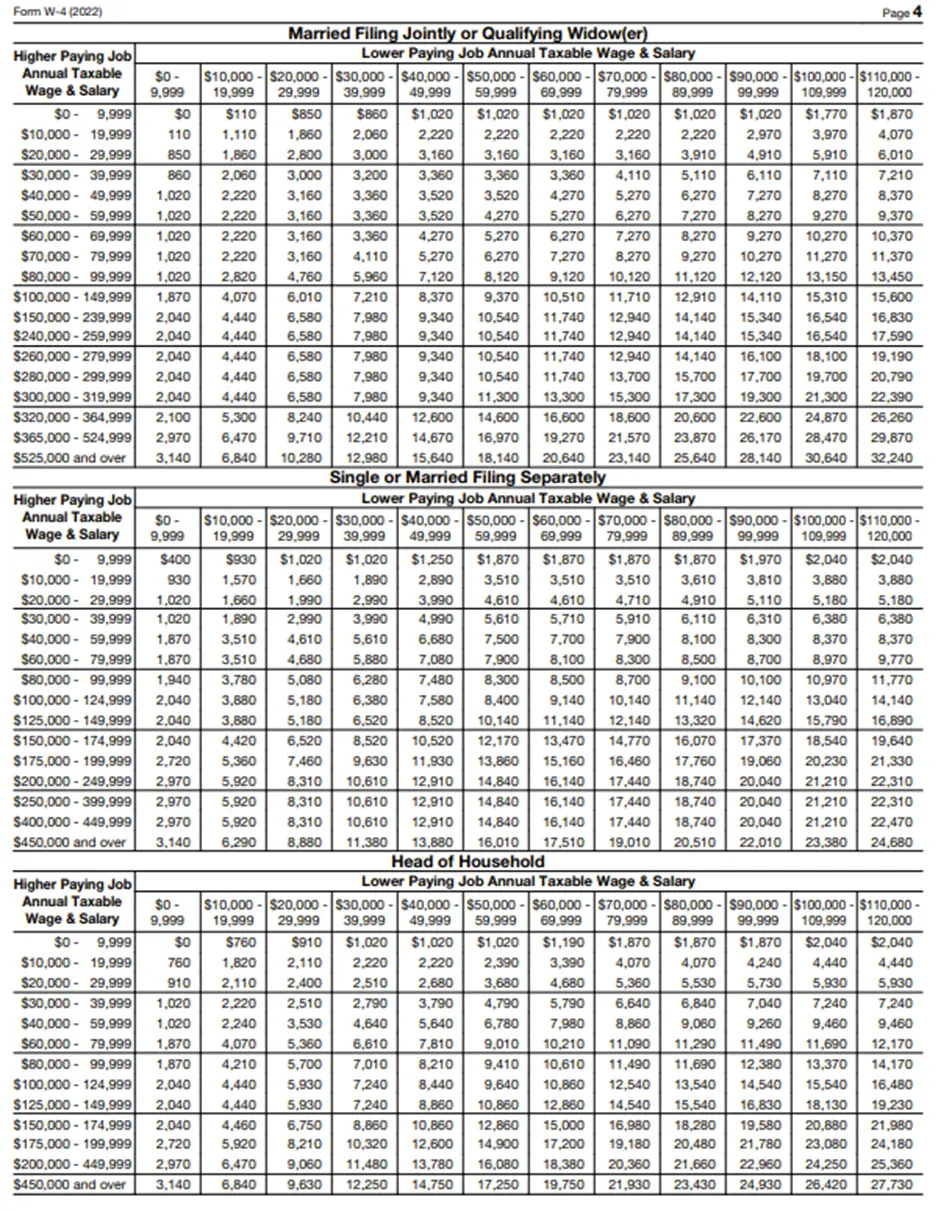

Step 2: Multiple Jobs or Spouse Works

The next section should be completed only if you hold more than one job or have a spouse who also works.

There are several options to complete step 2. You can use the estimator at www.irs.gov/W4App, complete

the multiple jobs worksheet on page 3 of the W-4, or simply check the box in step 2 if there are only

two jobs total with similar incomes. See supplemental worksheet section below for details about the

multiple jobs worksheet on page 3 of the Form W-4.

Step 3: Claim Dependents

If you have a total income less than $200,000 (or $400,000 if married filing jointly), you can complete

this section using information about your children or other dependents you will be claiming on your tax

return. In the first box, multiply your qualifying children under age 17 by $2,000. In the second box,

multiply your other dependents by $500. The third and final box is the sum total of the amounts above.

Step 4: Other Adjustments

Step four includes other adjustments to your withholdings. Line 4(a) covers increases to your

withholding and line 4(b) covers decreases to your withholding.

Line 4(a) is used if you have a job not subject to withholdings, such as an independent contracting or

freelancing job. This type of self-employment income is subject to self employment tax in addition to

your federal income taxes. You will have to pay estimated tax payments quarterly for your

self-employment income, but this form allows you to withhold more taxes from your main job. It can also

be used if you have interest, dividends, or retirement income that is not subject to withholdings.

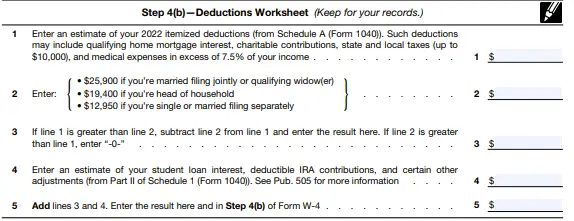

Line 4(b) allows you to reduce your withholdings based on additional deductions you may be eligible to

claim on your tax return. See supplemental worksheet section below for details about the deductions

worksheet on page 3 of the Form W-4.

Step 5: Sign

Once you are confident that the Form W-4 is completed to the best of your knowledge, you should sign and

date the form on step 5. Form W-4 is not valid if it is not signed.