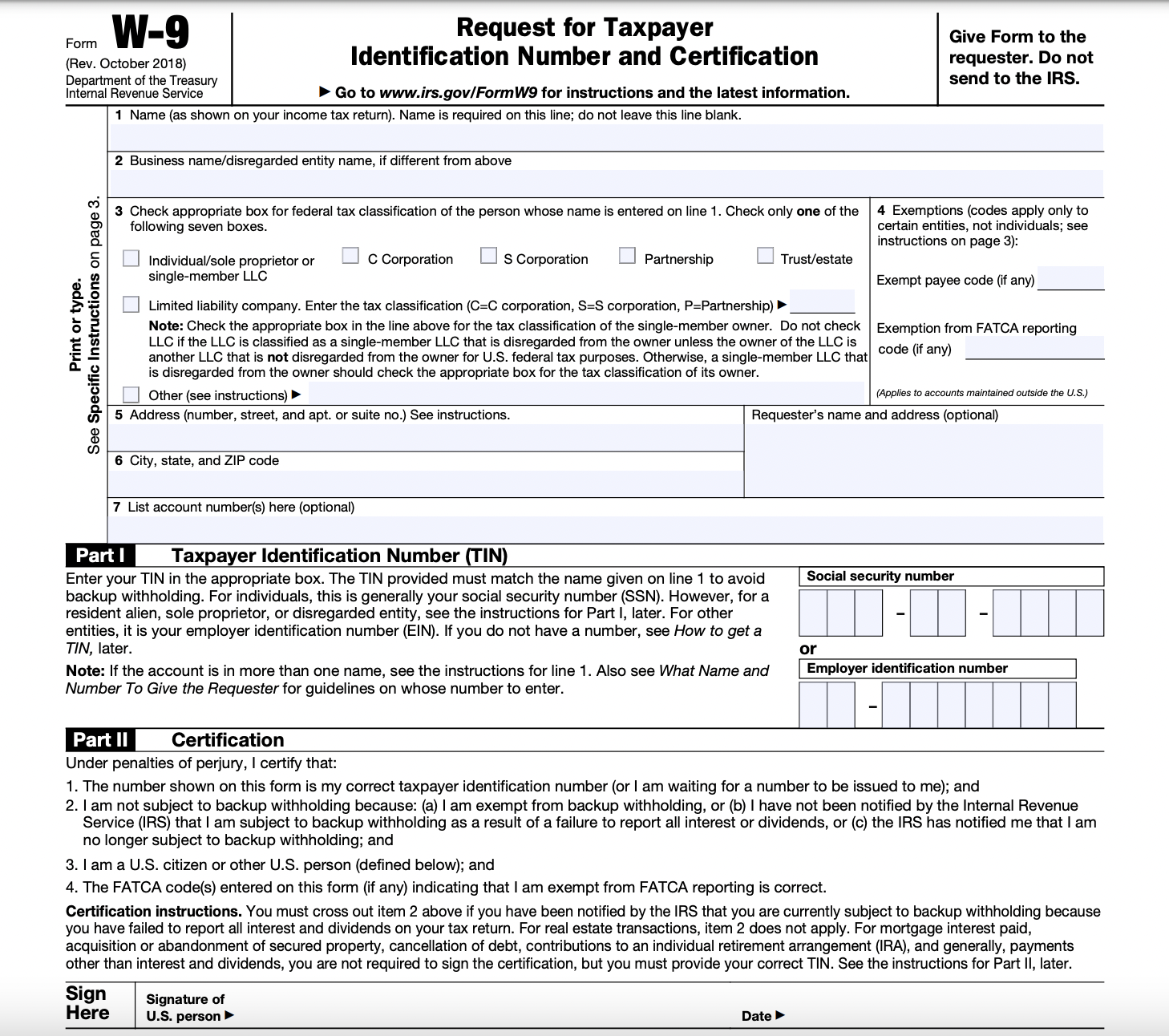

Form W-9 is a very easy and straightforward form to fill out and the form itself is not even an

entire page. You will receive around 6 pages but most of it is the instructions as well as home

guidance notes. The sections that you need to fill out are as follows:

Line 1 - Name: Fill in your full name.

Line 2 - Business name: You can leave this section blank if you do not have a business. If you

do

have a business name or some sort of trade name then you need to fill it in here.

Line 3 - Federal tax classification: Check the box that applies to you as this will how you as

an

independent contractor will be classified, when it comes to federal income tax.

Line 4 - Exemptions: This section does not apply to individuals but to certain entities only. If

you meet the requirements to fill out this section then you will need to provide a number or

letter code that indicates that reason.

Line 5 & 6 - Address, city, state and ZIP code: Fill in your full address so that the person

paying you can mail your information returns.

Line 7 - Account number(s): Your employer may need additional account numbers. If so then fill

it

out as instructed, or else leave it blank if it does not apply to you.

Part I - Taxpayer Identification Number (TIN): Here you want to provide your social security

number if you’re an individual or single-member LLC. If you’re a multi-member LLC classified as

a partnership, C Corporation or S Corporation then you can also provide your EIN (employer

identification number). Sole proprietors may include either of these numbers.

Part II - Certification: This section is where you sign and date the form which indicates that

all the information that you have provided is true.

Form W-9 is a legal document therefore it should be filled out prudently. Below is an image of

what Form W-9 looks like and the area where you fill in the information