What is Form 4868?

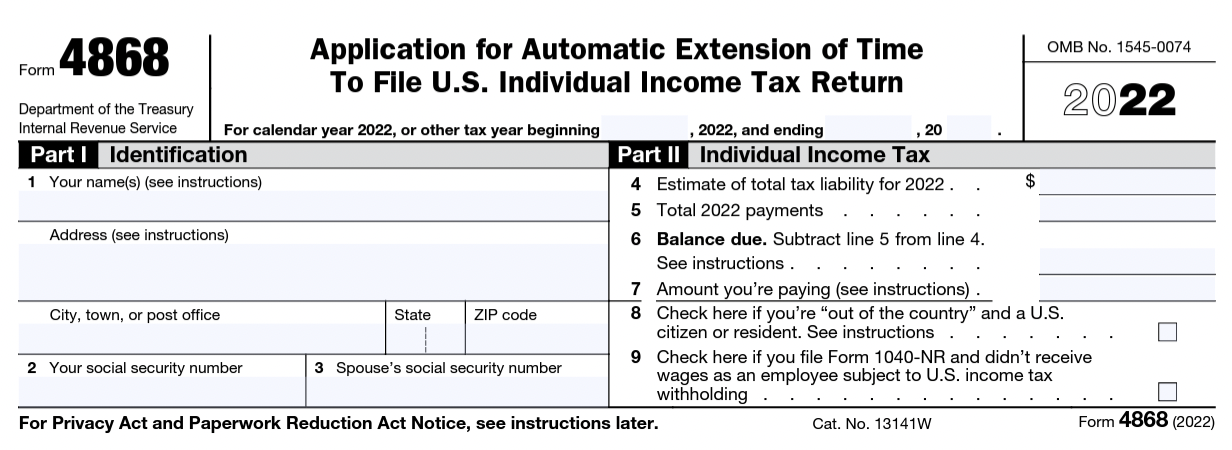

Form 4868 is the official United States tax document used by individual taxpayers to request an automatic extension of time to file their federal income tax return. The form's full title is "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return."

By submitting Form 4868, taxpayers can request an additional six months of time to file their tax return, making the extended due date October 15th for most taxpayers. However, it is important to note that Form 4868 does not provide an extension of time to pay any taxes owed. Taxpayers are still required to estimate and pay their tax liability by the original tax deadline, which is usually April 15th.

Form 4868 can be filed electronically using tax preparation software or through the IRS website. It can also be filed by mail by completing and mailing the paper form to the appropriate address listed in the form's instructions. Alternatively, tax professionals can prepare this form on behalf of the taxpayer.

Who needs to file Form 4868?

The following individuals may need to consider file Form 4868:

-

Individual taxpayers who need more time to file their tax return: If an individual taxpayer is unable to file their federal income tax return by the original due date, they can file Form 4868 to request an automatic extension of time to file. The extended due date for most taxpayers is October 15th.

-

Self-employed individuals: Self-employed individuals who file Schedule C with their tax return may want to file Form 4868 if they are unable to file their tax return by the original due date. This gives them more time to collect information such as 1099s, receipts for expenses, and more.

-

Individuals with rental income: Taxpayers who own rental properties and file Schedule E with their tax return may want to file Form 4868 if they are unable to file their tax return by the original due date.

-

Individuals with investment income: Taxpayers who have investment income and file Schedule D with their tax return may want to file Form 4868 if they are unable to file their tax return by the original due date.

It's important to note that filing Form 4868 does not extend the deadline for paying any taxes owed. Taxpayers are still required to estimate and pay their tax liability by the original tax deadline, which is usually April 15th. Any taxes owed that are not paid by the original due date may be subject to penalties and interest, so it’s worth making sure you pay on time.

Who is not required to file Form 4868?

Taxpayers who are able to file their federal income tax return by the original due date are not required to file Form 4868. Additionally, certain taxpayers may not need to file Form 4868 because they are granted an automatic extension of time to file their tax return without having to request an extension.

For example, taxpayers who are out of the country on the original due date of their tax return are automatically granted an extension to June 15th without having to file Form 4868. However, any taxes owed must still be paid by April 15th to avoid penalties and interest.

Taxpayers who are in a combat zone or a qualified hazardous duty area may also be granted an automatic extension of time to file their tax return without having to file Form 4868. In some cases, the extension may be longer than six months.

Even if a taxpayer is not required to file Form 4868, they must still pay any taxes owed by the original tax deadline to avoid penalties and interest.

When is the deadline for Form 4868?

The deadline for filing Form 4868 is usually the same as the deadline for filing an individual federal income tax return, which is April 15th. However, if April 15th falls on a weekend or a holiday, the deadline may be extended to the next business day.

If approved, Form 4868 grants a six-month extension of time to file an individual tax return, which means the new deadline to file the tax return will be October 15th. It's important to note that this extension of time applies only to filing the tax return, not to paying any taxes owed.

Taxpayers can file Form 4868 electronically using third party tax preparation software or on the IRS website, by paper through the mail, or by soliciting the help of a tax professional. If filing by mail, the form must be postmarked by April 15th to be considered timely filed. If filing electronically, the form must be submitted by the end of the day on April 15th.

Can the deadline for Form 4868 be extended?

The deadline for filing Form 4868 cannot be extended beyond October 15th. This means that if a taxpayer has already been granted an automatic six-month extension by filing Form 4868, they must file their federal income tax return by October 15th. If they do not file by this deadline, taxpayers may incur potentially significant late fees and penalties.

However, in certain circumstances, taxpayers may be eligible for additional time to file their tax return. For example, taxpayers who are affected by a federally declared disaster or are serving in a combat zone or qualified hazardous duty area may be eligible for an additional extension of time to file their tax return.

Taxpayers who need additional time beyond the extension period granted by Form 4868 or other special extensions should contact the IRS to discuss their options. Even if a taxpayer is granted additional time to file their tax return, any taxes owed must still be paid by the original tax deadline to avoid penalties and interest.

What is the penalty for late filing of Form 4868?

There is generally no penalty for filing Form 4868 late if the taxpayer meets certain requirements and files the form by the original tax deadline, which is usually April 15th. Specifically, if the taxpayer properly files Form 4868 by the original tax deadline and:

-

Pays at least 90% of the total tax liability for the year with the extension request, and

-

Files a tax return and pays the remaining balance by the extended due date

then the taxpayer will generally not be subject to a late filing penalty.

However, if the taxpayer does not file Form 4868 by the original tax deadline or does not meet the payment requirements described above, they may be subject to a late filing penalty. The penalty is generally 5% of the unpaid tax liability per month, up to a maximum of 25% of the unpaid tax liability. The penalty begins accruing on the day after the tax deadline and continues until the return is filed or until 5 months have passed, whichever comes first.

The penalty for late filing of Form 4868 is separate from the penalty for late payment of taxes owed. If the taxpayer does not pay the taxes owed by the original tax deadline, they may be subject to a separate penalty of 0.5% of the unpaid tax liability per month, up to a maximum of 25% of the unpaid tax liability.

What happens if I don't file Form 4868?

While failure to file Form 4868 does not incur penalties by itself, failure to file your individual tax return, or failure to pay taxes owed by the due date, does. While you must always pay taxes on time, filing Form 4868 extends the due date to file your tax return, thus avoiding initial late filing penalties.

If you neglect to file Form 4868 and do not file your tax return on time, the penalty for late filing is generally 5% of the unpaid tax liability per month, up to a maximum of 25% of the unpaid tax liability. The penalty begins accruing on the day after the tax deadline and continues until the return is filed or until 5 months have passed, whichever comes first.

In addition to the late filing penalty, you may also be subject to a penalty for late payment of taxes owed if you do not pay the taxes owed by the original tax deadline. The penalty for late payment is generally 0.5% of the unpaid tax liability per month, up to a maximum of 25% of the unpaid tax liability.

If you do not file your tax return or request an extension of time to file by the extended due date, the IRS may take further action to collect the taxes owed, including assessing additional penalties and interest, filing a substitute return on your behalf, or initiating collection actions such as wage garnishment or a tax lien. It's important to file your tax return or request an extension of time to file by the original tax deadline to avoid these penalties and consequences.

What supporting documents do I need to file with Form 4868?

When filing Form 4868, there are no supporting documents that need to be submitted. However, you will need to fill out certain information on the form, such as:

-

Your name, address, and Social Security Number (SSN) or Taxpayer Identification Number (TIN)

-

Your spouse's name and Social Security Number (if filing jointly)

-

An estimate of your total tax liability for the year

-

An estimate of the amount of tax you have already paid for the year (estimated tax payments)

-

The amount of any tax payment you are making with the extension request, if applicable (your total estimated tax liability minus any estimated tax payments already made.

While no supporting documents need to be submitted with Form 4868, you should still keep records of any income, deductions, and credits that you will report on your tax return. This will help ensure that your tax return is accurate and complete when you file it later.

How do I file for Form 4868?

There are three ways to file for Form 4868:

-

Pay part or all of the estimated income tax due and indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System, or using a credit or debit card.

-

File the form electronically by getting access to the IRS e-file using your choice of tax software or a tax consultant who uses e-file.

-

File a paper Form 4868 and enclose payment of the estimate of tax due (optional). Then mail it to the address listed in the form’s instructions.

Regardless of how you file, it's important to make sure that your extension request is filed by the original tax deadline to avoid any potential penalties for late filing.

Where should I mail Form 4868 to?

If you choose to file a paper Form 4868, you should mail the form to the appropriate address listed in the form's instructions based on your state of residence and whether you are including a payment with your extension request. The instructions provide separate mailing addresses for taxpayers who are making a payment with their extension request and those who are not.

These are the appropriate mailing addresses listed in Form 4868’s instructions as of March 2023:

| If you live in: | And you’re making a payment, send Form 4868 with your payment to Internal Revenue Service: | And you’re not making a payment, send Form 4868 to Department of the Treasury, Internal Revenue Service Center: |

| Florida, Louisiana, Mississippi, Texas | P.O. Box 1302, Charlotte, NC 28201-1302 | Austin, TX 73301-0045 |

| Arizona, New Mexico | P.O. Box 802503, Cincinnati, OH 45280-2503 | Austin, TX 73301-0045 |

| Arkansas, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | P.O. Box 931300, Louisville, KY 40293-1300 | Kansas City, MO 64999-0045 |

| Pennsylvania | P.O. Box 802503, Cincinnati, OH 45280-2503 | Kansas City, MO 64999-0045 |

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington, Wyoming | P.O. Box 802503, Cincinnati, OH 45280-2503 | Ogden, UT 84201-0045 |

| Alabama, Georgia, North Carolina, South Carolina, Tennessee | P.O. Box 1302, Charlotte, NC 28201-1302 | Kansas City, MO 64999-0045 |

| A foreign country, American Samoa, or Puerto Rico, or are excluding income under Internal Revenue Code section 933, or use an APO or FPO address, or file Form 2555 or 4563, or are a dual-status alien, or are a nonpermanent resident of Guam or the U.S. Virgin Islands | P.O. Box 1303, Charlotte, NC 28201-1303 | Austin, TX 73301-0215 |

| All foreign estate and trust Form 1040-NR filers | P.O. Box 1303, Charlotte, NC 28201-1303 USA | Kansas City, MO 64999-0045 USA |

| All other Form 1040-NR, 1040-PR, and 1040-SS filers | P.O. Box 1302, Charlotte, NC 28201-1302 USA | Austin, TX 73301-0045 USA |

Be sure to double check that you’re using the correct mailing address for your state of residence by referring to the instructions for Form 4868. The instructions can always be found on the IRS website or by downloading Form 4868 from the IRS website.

Can I file Form 4868 electronically?

Yes, you can file Form 4868 electronically using tax preparation software or through the IRS website. Filing electronically is the easiest and fastest way to request an extension of time to file your federal income tax return.

To file electronically, you will need to provide certain information on the form, such as your name, address, Social Security number or taxpayer identification number, and an estimate of your total tax liability for the year. You can also make an electronic payment with your extension request using Direct Pay, the Electronic Federal Tax Payment System (EFTPS), or a credit or debit card.

Filing electronically has several advantages over filing a paper form. First, it's faster and more convenient, as you can file from anywhere with an internet connection. Second, you will receive an electronic confirmation of your extension request, which provides peace of mind that your request was received and processed. Finally, filing electronically can help reduce errors and ensure that your extension request is processed accurately and quickly.

To file Form 4868 electronically, you can use IRS Free File, which offers free online tax preparation and e-filing services to taxpayers who meet certain income and other eligibility requirements. You can also use commercial tax preparation software, which may charge a fee for their services. Additionally, you can file electronically directly through the IRS website using their Online Payment Agreement or Direct Pay services.

If you need to produce pay stubs for either yourself or your employees, you may do so by using the online paystubs generator. There are variations of pay stubs templates there for you to choose from.