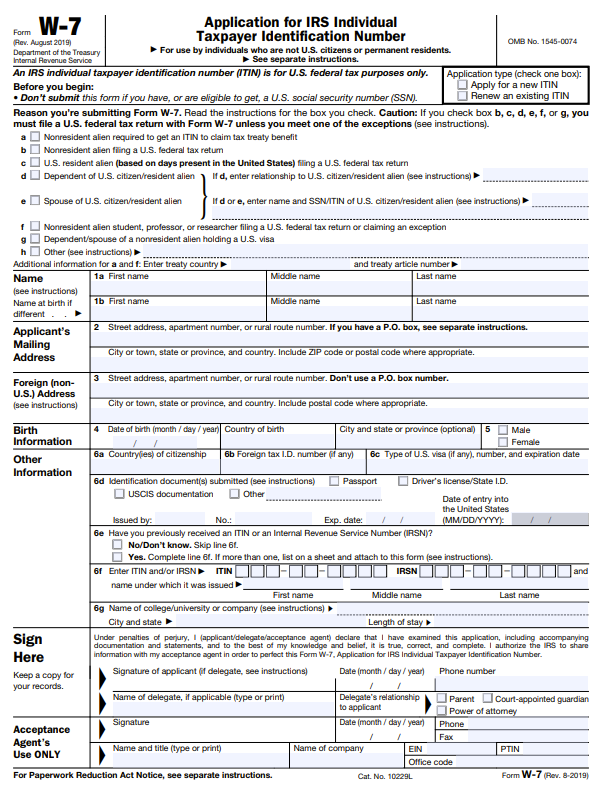

The Form W-7 is only one page long, but there are several sections to complete.

Application Type

The box at the top right of a Form W-7 asks for your application type. Check the box next to the

correct line to indicate if this is an original W-7 applying for a new ITIN or if this is a

renewal of an existing ITIN.

Reason You're Submitting Form W-7

You should check the box next to your reason for submitting Form W-7. The options are:

- A: nonresident alien required to get an ITIN to claim tax treaty benefit

- B: Nonresident alien filing a U.S. tax return

- C: U.S. resident alien (based on days present in the United States) filing a U.S. tax

return

- D: Dependent of U.S. citizen/resident alien

- E: Spouse of U.S. citizen/resident alien

- F: Nonresident alien student, professor, or researcher filing a U.S. tax return

- G: Dependent/spouse of a nonresident alien holding a U.S. visa

- H: Other

If you check D, you will need to enter your relationship to a U.S. citizen or resident alien. If

you checked D or E, you will have to enter the name and SSN of the U.S. citizen or resident

alien who is your spouse or claiming you as a dependent.

If you check H, you will have to describe in detail your reason for requesting an ITIN and

attach supporting documentation.

Name

Enter your first, middle, and last names on line 1a. If your birth name was different, you can

enter it on line 1b.

Applicant's Mailing Address

Enter your mailing address, city or town, state or province, and country in line 2. This is the

address the IRS will use to return your original documents and send written notice of your ITIN

application status.

Foreign (non-U.S.) Address

Enter your complete foreign address in the country in which you permanently or normally reside

in line 3. You should complete line 3 even if the information is the same as line 2. If you've

permanently relocated to the United States, you should enter only the foreign country in which

you previously resided.

Birth Information

Line 4 asks for your date of birth and location of birth. Line 5 has check boxes for male or

female.

Other Information

Enter the country or countries in which you're a citizen in line 6a. If the country from 6a has

given you a tax

identification number, enter that on line 6b. For example, if you're a Canadian

citizen, you would enter your Canadian Social Insurance Number. If you have a U.S. visa, list

the visa type, visa number, and expiration date in 6c.

Check the box next to any identification documents that you are mailing with the return in box

6d. If you include a valid passport, enter the issuing country, number, expiration date, and the

date of entry into the U.S. in the box as well.

Sign Here

Your W-7 will not be accepted without your signature. Sign and date the form and enter a phone

number in this section. If you used a delegate to complete your form, enter their information

and relationship to you as well.

Acceptance Agent's Use Only

If you use an acceptance agent to file the form with the IRS,

they will enter their own information at the very bottom of the form.