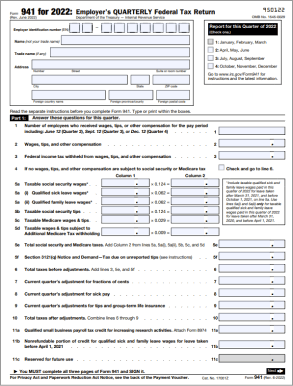

The top section of IRS Form 941 identifies your business to the IRS. To complete Form 941, you

will need a valid Employer Identification Number (EIN) assigned to you by the IRS. The business

name associated with your EIN goes in the box labeled Name and a "Doing Business As" (DBA), if

applicable, goes in the box for Trade Name. Next, enter your business's address and check the

box for the appropriate quarter in the section titled "Report for this Quarter of 20XX."

You can use information from your payroll software to fill in information in Part 1.

-

Line 1 is where you enter the number of employees who received wages, tips, or other

compensation in the quarter

- Line 2 is for wages, tips, and other compensation paid in the quarter

- Line 3 is for federal income tax withheld from wages, tips, and other compensation

-

Check the box on line 4 if you had wages, tips, or other compensation not subject to social

security or Medicare taxes.

- Line 5a is for total taxable social security wages

-

Line 5a(i) is for qualified sick leave wages (only for wages paid in this quarter for leave

taken after March 31, 2021 and before October 1, 2021)

-

Line 5a(ii) is for qualified family leave wages (only for wages paid in this quarter for

leave taken after March 31, 2020 and before April 1, 2021)

- Line 5b is for total taxable social security tips

- Line 5c is for total taxable Medicare wages and tips

-

Line 5d is only for wages over $200,000 that are subject to additional Medicare tax

withholding

- Line 5e is the sum of the second column from lines 5a to 5d

-

Complete line 5f only if you have received a Section 3121(q) Notice and Demand from the IRS

indicating unreported tips by an employee

- Line 6 is the sum of lines 3, 5e, and 5f (if applicable)

- Line 7 is the adjustment for fractions of cents

- Line 8 is the adjustment for sick pay

- Line 9 is the adjustment for tips and group-term life insurance

- Line 10 is your total taxes after adjustments

- Lines 11a to 11g are for various nonrefundable credits

- Line 12 is your total taxes after adjustments and nonrefundable credits

- Lines 13a to 13f are for your total deposits in the quarter and refundable credits

- Line 13g sums your total deposits and refundable credits

- Line 14 shows your balance due, if line 12 is greater than line 13g

- Line 15 shows your overpayment, if line 13g is greater than line 12

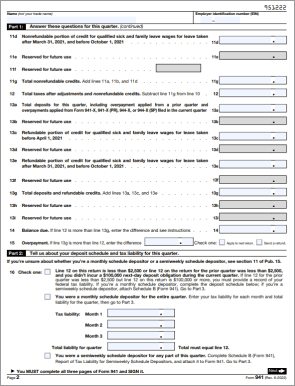

Part 2 requests information about your deposit schedule and tax liability for the quarter. Check

the correct boxes based on your total tax. Enter your monthly tax liability on the three lines

in part 2 if you are a monthly depositor. Complete Schedule B, Report of Tax Liability for

Semiweekly Schedule Depositors, and attach to Form 941 if you are a semiweekly depositor.

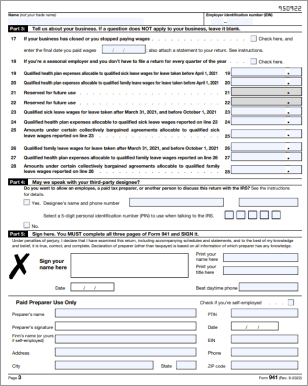

Part 3 asks questions about your business. If it's your final return, check the box on line 17.

If you are a seasonal employer and will be skipping other quarters, check the box on line 18.

Lines 19 to 28 ask questions about sick or family leave.

Part 4 designates an employee, a tax preparer, or another person to discuss the form with the

IRS.

Part 5 is where you'll need to sign your name to indicate the information is accurate to the

best of your knowledge, under penalty of perjury. A paid preparer completes the bottom section,

if applicable. You must complete all three pages of the Form 941 and sign on the third page, or

your form may not be processed by the IRS.