We've Helped Customers Create Their 1099-INT Form Using Our Generator

Online Form 1099-INT Generator

What Is Form 1099-INT?

Form 1099-INT, Interest Income Statement, is the official form for reporting interest income to the IRS. Form 1099-INT can include interest income from sources such as bank accounts, loan repayments, high-interest savings accounts, credit unions, and other financial institutions. This income is generally considered taxable by the IRS, and the amount reported on the IRS’s official Form 1099-INT will be included on your tax return for the year.

What Is Form 1099-INT Used For?

Form 1099-INT is used to report interest income and information related to the interest payer and the income recipient. These forms are prepared and filed by the payer, and copies are sent to both the recipient of the interest income and to the IRS for reporting purposes. When you receive a Form 1099-INT, the interest income reported on it will generally be included on your Schedule B of your Form 1040 individual income tax return for the year.

Who Receives Form 1099-INT?

Anyone who received taxable interest income of $10 or more during the tax year can expect to receive Form 1099-INT and should include that interest income on their Form 1040 Income Tax Return. These forms are prepared and sent from banks, financial institutions, mortgage brokers, credit unions, and more.

How To Get Your Forms 1099-INT

Your financial institution should send you your Form 1099-INT by January 31st following the year you received interest income without you having to do anything. You’ll either receive it in the mail or in digital form on their website. Generally, to access your Forms 1099-INT, all you’ll have to do is log onto the financial institution’s website and download your forms.

What If I Don’t Receive My 1099-INT Automatically?

If the payer does not automatically prepare and send your Forms 1099-INT, or if you are unable to find those forms, you should call the financial institution, email them, or use the live chat feature on their website to request your Forms 1099-INT from them.

What Is The Form 1099-INT Income Limit?

There is no upper limit for reporting interest income on Form 1099-INT, and any amount you received should be included on your tax return. The lower limit is generally $10. If you received less than $10 from a financial institution, they may not send you a Form 1099-INT, in which case you won’t need to report that interest income on your tax return.

Who Must File Form 1099-INT?

Any financial institution who generated and paid interest income of any kind over $10 will be required to prepare and file Forms 1099-INT to report those income sources. They must also send copies to any interest income recipients in addition to the IRS.

Sources Of Interest Income

Interest income can be earned from a number of sources. Below are several interest income sources that you might encounter. Interest income you receive from any of these sources will result in a Form 1099-INT:

-

Interest earned on checking and savings accounts.

-

Interest earned from loans you make to others.

-

Interest received from owning Certificates of Deposit (CDs).

-

Interest on annuity contracts you own.

-

Interest income from federal obligations such as US treasury bonds.

-

Original Issue Discounts (OIDs) on long-term debt contracts.

-

Interest accrued on income tax refunds.

Should you wish to prove your income, you can always use the online check stub maker. There are dozens of printable paystub samples for you to choose from.

Exceptions To Filing Requirements

Form 1099-INT generally does not need to be filed if the interest income for the account is lower than $10 for the tax year in question. Most checking and savings accounts offer very low annual percentage yields (APYs), so the interest earned from those accounts is often under the $10 threshold and is generally not reportable to the IRS.

What Is The Due Date For Filing Form 1099-INT?

Institutions who pay interest must send a copy Form 1099-INT to both the recipient of interest income (the payee) and to the IRS. There are three separate deadlines to keep in mind for sending out copies of Form 1099-INT...

Date 1: January 31st - Recipient Copies

The payer is required to send the form to the recipient by January 31st. This gives the recipient enough time to compile and understand the forms 1099-INT before their individual 1040 tax returns are due on April 18th.

Date 2: February 28th - Paper Filing

If the payer is paper filing their Forms 1099-INT, they must mail them to the IRS by February 28th.

Date 3: March 31st - Electronic Filing

If the payer is filing their Forms 1099-INT electronically, they must submit them to the IRS by March 31st.

Where Is Form 1099-INT Filed?

Form 1099-INT can either be mailed or filed electronically, depending on your preference. Filing online is generally faster than paper filing, so the IRS gives you an entire extra month to file electronically versus paper filing (3/31 vs 2/28). Forms 1099-INT must be submitted to the IRS along with Form 1096, Annual Summary and Transmittal of U.S. Information Returns, which summarizes the returns being filed.

How Do I File Form 1099-INT Online?

The IRS has created the free FIRE System, which stands for Filing Information Returns Electronically, to file

information returns (including Form 1099-INT) online for free. You can

access the FIRE System by clicking here.

NOTE: the FIRE website is taken offline for updates every year, so you won’t be able to use it until January 3rd at 12:00 noon ET (Eastern Time).

How Do I Paper File Form 1099-INT?

To paper file Forms 1099-INT with the IRS, order scannable versions of Form 1099-INT Copy A (the copy you’ll send to the IRS) and Form 1096, “Annual Summary and Transmittal of U.S. Information Returns”, from the IRS’s form ordering website. Once you receive them, you can either fill out the required information by hand, or print the information on the forms by inserting the red forms into a printer. Once the 1099-INT and 1096 are properly filled out, place them in a sealed and postmarked envelope addressed to the IRS (see addresses below).

Forms 1099-INT Copy B can be printed directly from the online version, and you do not need to order them from the IRS. Again, you can either hand write the information or print it with your printer. Once the information is filled out, place each Form 1099-INT into its own envelope addressed to the recipient of the interest income.

We recommend using certified mail and requesting a return receipt to track your forms and prove you mailed them on time. They should be mailed using either the US Postal Service or another accepted Private Delivery Service. You’ll mail them to one of four addresses based on your place of residence:

| If your business or residence is located in the following… | Then mail your Form 1096 and Forms 1099-INT to… |

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Internal Revenue Service, P.O. Box 149213 Austin, TX 78714-9213 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Internal Revenue Service Center, P.O. Box 219256 Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Internal Revenue Service Center, 1973 North Rulon White Blvd. Ogden, UT 84201 |

| If your legal residence or principal place of business is outside the United States | Internal Revenue Service, P.O. Box 149213, Austin, TX 78714-9213 |

*Refer to the IRS’s General Instructions for Certain Information Returns for more information.

Where Do I Enter Form 1099-INT On My Tax Return?

The interest income reported on Form 1099-INT will appear on your Form 1040 Individual Income Tax Return in a few places. First, all interest income will be included on Schedule B, Interest and Ordinary Dividends. Schedule B calculates the total taxable interest income that will appear on your tax return for the year, so all interest income reported on Forms 1099-INT will be included here.

Once the total interest income has been calculated on Schedule B, interest income will be carried over to Form 1040, Page 1, Line 2b. This income will increase your Adjusted Gross Income (AGI) on Line 11 and will be used in the calculation of your taxable income.

Additionally, taxable interest income will most likely be reported on your state tax return, and the amount of tax you’ll pay depends on your state’s tax rates. There are nine states that do not have any income tax. They include: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. If you live in one of these states, your interest income may not be taxed at all. If you live in another state, it is likely that your interest income will be subject to state income taxes. Contact a CPA or refer to your tax filing software to determine if your interest income is subject to state income taxes.

*NOTE: Form 1040, and its associated schedules, are updated annually at the end of the year. As a result, the 2022 Form 1040 will become available in January, 2023.

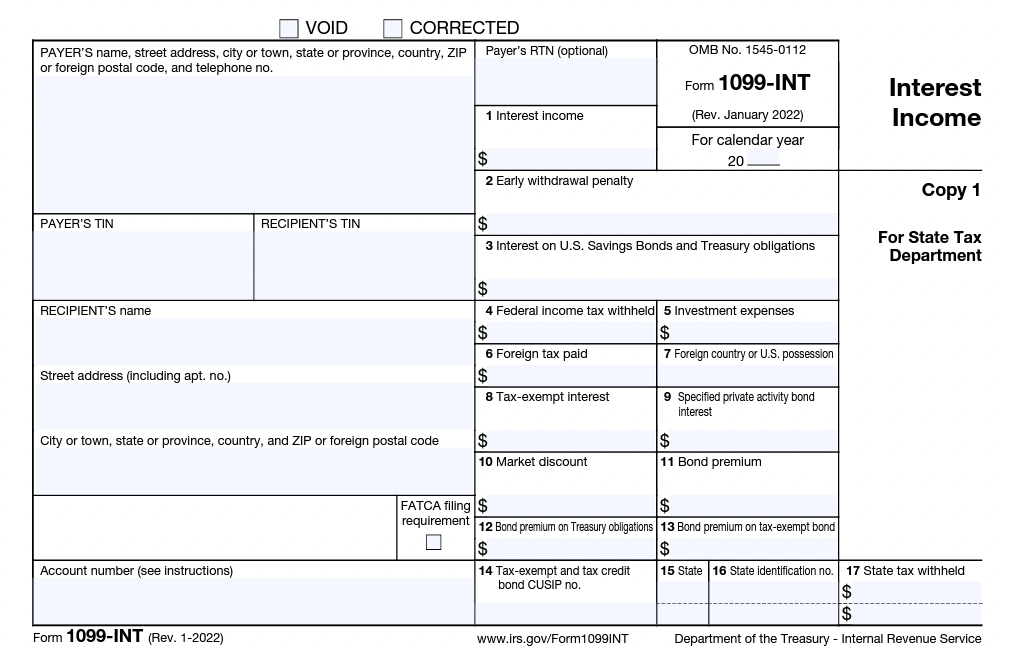

What Is Reported On Form 1099-INT?

Form 1099-INT reports interest income and information related to it, such as payer and recipient addresses, phone numbers, and Tax Identification Numbers (TINs). Take a look at the IRS’s official Form 1099-INT to learn more.

Account Number

This should be filled out if the payer created a unique account number to distinguish your account from others. For example, a bank that pays interest periodically could include your bank account number here.

Box 1. Interest Income

The first box includes the total taxable interest income paid to you during the year by the payer. Box 1 should include income of $10 or more, and should not include any income from box 3 (Interest on U.S. Savings Bonds and Treasury obligations).

Box 2. Early Withdrawal Penalty

The second box shows the amount of income not earned due to early withdrawal of time savings. The IRS allows you to deduct this amount when calculating your adjusted gross income on your tax return.

Box 3. Interest on U.S. Savings Bonds and Treasury obligations

The third box shows interest income from US savings bonds, treasury bills, treasury bonds, and treasury notes.

Box 4. Federal income tax withheld

The fourth box shows any federal taxes already paid to the IRS related to the taxable interest income in box 1. You should include this amount on your tax return as tax withholdings.

Box 5. Investment expenses

The fifth box shows your portion of any investment expenses incurred as a Real Estate Mortgage Investment Conduit (REMIC). This box will be blank for most taxpayers unless you are actively involved in real estate.

Box 6. Foreign tax paid

The sixth box shows the amount of foreign taxes already paid on the interest income included in box 1. You may be able to claim this amount as either a tax deduction or a foreign tax credit on your income tax return.

Box 7. Foreign country or U.S. possession

The seventh box shows the foreign country or US possession to which foreign taxes were paid. This information may be relevant when claiming a foreign tax credit on your tax return.

Box 8. Tax-exempt interest

The eighth box shows tax-exempt interest you received during the year. Read the Form 1040 instructions to determine how this interest income should be handled.

Box 9. Specified private activity bond interest

The ninth box shows tax-exempt interest income that is subject to the Alternative Minimum Tax (AMT). Read the instructions for Form 6251, Alternative Minimum Tax, to determine how this amount should be handled.

Box 10. Market discount

The tenth box shows market discounts that accrued on tax-exempt debt instruments you held during the tax year, if not otherwise reported on Form 1099-OID. The total accrued market discount should be reported on your tax return as described by the Form 1040 instructions.

Box 11. Bond premium

The eleventh box shows the amount of bond premium amortization allocable to the interest payments of a taxable covered security (other than a US treasury obligation) held by you during the tax year. Refer to the instructions for Form 1040 to determine the net interest includible on Form 1040, Schedule B.

Box 12. Bond premium on Treasury obligations

The twelfth box shows the amount of bond premium amortization allocable to the interest payments of a US treasury bond held by you during the tax year. Refer to the instructions for Form 1040 to determine the net interest includible on Form 1040, Schedule B.

Box 13. Bond premium on tax-exempt bond

The thirteenth box shows the amount of premium amortization allocable to the interest payments of a tax-exempt covered security held by you during the tax year. Be sure to check the Form 1099-INT instructions to determine how to report From 1099-INT Box 13. Refer to the instructions for Form 1040 to determine how to include this amount on your tax return.

Box 14. Tax-exempt and tax credit bond CUSIP no.

The fourteenth box shows the CUSIP numbers for tax-exempt bonds on which tax-exempt interest was paid, or tax credit bonds on which taxable interest was paid during the tax year.

Box 15-17. State, State identification no., and State tax withheld

These boxes report state information for state tax withholdings during the tax year.