We've Helped Customers Create Their 1098 Form Using Our Generator

What Is Form 1098?

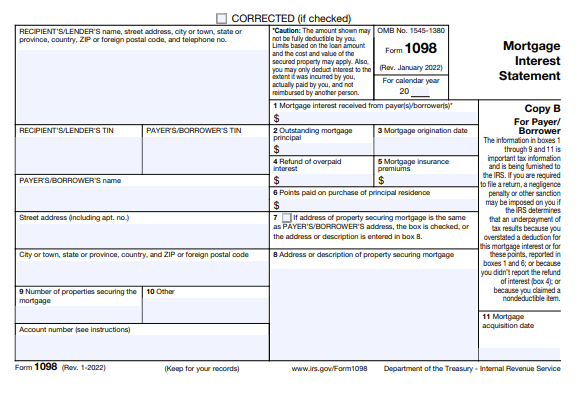

Form 1098, Mortgage Interest Statement, is an informational tax return used to report mortgage interest totalling $600 or more that is received from an individual during the calendar year in the course of a trade or business. Form 1098 can also be used to report mortgage insurance premiums (MIP) totalling $600 or more that is received from an individual during the calendar year in the course of a trade or business.

For the purposes of filing Form 1098, a mortgage is defined as any obligation secured by real property, including land and anything attached to, growing on, or built on the land. It also includes manufactured homes with a minimum living space of 400 square feet and a minimum width of 102 inches.

Who Must File Form 1098?

If you received mortgage interest payments from an individual totalling $600 or more in a year in the course of your trade or business, you should file a Form 1098 to report the income. If it was received in the course of your trade or business, you are subject to the Form 1098 reporting requirement, even if you are not typically in the business of lending money.

For example, a real estate developer who provides financing to an individual to buy a home in the subdivision he developed would be subject to the Form 1098 reporting requirements. On the other hand, a person not otherwise engaged in any trade or business, who lends money to an individual to buy his personal home is not subject to the Form 1098 reporting requirement. He did not receive the mortgage interest in the course of his trade or business

The $600 mortgage interest threshold applies to each mortgage separately, so there is no requirement to file Form 1098 if the total of mortgage interest payments is less than $600 for the year. However, you can optionally file Form 1098 to report mortgage interest you received, even if it is less than $600 in total.

Exception To Filing Requirement

There is an exception for mortgage interest received from a corporation, partnership, trust, estate, association, or company. You do not need to file a Form 1098 for interest received from these types of organizations, even if an individual is listed as a co-borrower

When Is The Due Date For Filing Form 1098?

There are two due dates for filing Form 1098. The form is due to the borrower by January 31 of the year following the calendar year being reported. The form is due to the Internal Revenue Service (IRS) by February 28 of the year following the calendar year being reported, unless it is filed electronically. Forms filed electronically are due to the IRS by March 31.

Late Filing Penalties

If you file a Form 1098 late, you will be subject to penalties. The penalty is $50 per informational return filed less than 30 days late, $110 if filed more than 30 days late but before August 1, and $290 if never filed or filed after August 1.

Extension Of Time To Furnish Statements To Recipients

You can file an extension of time to furnish statements to recipients by fax only. The letter can be sent to:

Internal Revenue Service Technical Services Operation

Attn: Extension of Time Coordinator

Fax: 877-477-0572

Your extension letter must include the payer name, TIN, payer address, type of return (Form 1098), a statement about requesting an extension of time to provide statements to recipients, the reason for delay, and a signature of an authorized agent. The request must be faxed no later than the January 31 due date for furnishing informational returns to recipients, and approved extensions are typically only granted for 30 extra days.

Where Is Form 1098 Filed?

You can file a Form 1098 electronically or through the mail. If you mail the Form 1098, you will meet the due date requirements if the form is properly addressed, postmarked, and mailed using the U.S. postal service or an accepted private delivery service (PDS). The IRS lists its currently accepted PDSs, here. The address where you must mail your Form 1098 depends on the state or province in which your business is located.

The IRS also encourages all filers to file electronically if possible. You can electronically file the Form 1098 on the Filing Information Returns Electronically System (FIRE System). If you must file more than 250 Forms 1098 throughout the year, you have to use the FIRE System to file electronically.

Who Receives Form 1098?

If you have borrowed money to finance a purchase of real property, you may receive a Form 1098. You will receive the form if you have paid more than $600 in mortgage interest or mortgage insurance premiums during the previous year.

There are three copies of the Form 1098, and three different entities receive each copy.

- Copy A: Internal Revenue Service: This copy goes directly from your lending agency to the IRS. This allows the IRS to confirm information you enter directly on your tax return against what the lending agency provided.

- Copy B: Payer/Borrower: This is the copy you will receive in the mail from your lending agency. You can use this form to enter information on your Form 1040, U.S. Individual Income Tax Return. If you need to generate a paystub as proof of income, you may use the paystub generator. There are many variations of paystub templates available for you to choose from.

- Copy C: Recipient/Lender: This copy is retained by the lending agency for their own records.

How To Get Form 1098

Your lending agency is required to furnish you with the Form 1098 by January 31. You may receive it in the mail, or you may receive a link to download the form directly from your lending agency.

Splitting Mortgage Interest Deduction

If you received a Form 1098, it is because you are the borrower on record with the lending agency. If you split the interest and payments with other borrowers not listed on the mortgage documents, you will be allowed to deduct only the amount you have paid. You should share the Form 1098 with any additional borrowers so they can deduct the portion of the interest payments they have made on their tax returns.

For example, if you are in a domestic partnership and the mortgage is only in your name, you may share the bills with your partner 50/50. If you split the payments 50/50, you can only deduct 50 percent on your own tax return, while your partner deducts 50 percent on theirs.

Where Do I Enter Form 1098 On My Tax Return?

If you itemize your income tax deductions, you can use the information reported to you on the Form 1098 to receive a deduction on your taxes. If you take the standard deduction, you do not need to do anything with the Form 1098 on your tax return.

Schedule A, Itemized Deductions, of the Form 1040 is where you enter your itemized deductions. Line 8a of the Schedule A is for home mortgage interest reported to you on the Form 1098. Line 8d is for mortgage insurance premiums reported to you on the Form 1098. If you paid mortgage interest or points during the year that was not reported to you on Form 1098, you can use lines 8b and 8c.

Limit On Mortgage Interest Deduction

There is a limit on the amount of mortgage interest that you are allowed to deduct. If you purchased your home after December 15, 2017, you are limited to interest paid on the first $750,000 ($375,000 if married filing separately) of the mortgage. If you purchased your home and incurred the debt prior to that date, the amount is $1 million ($500,000 if married filing separately).

Exception on Lower Limitation

There is an exception if you entered into a binding contract prior to December 15, 2017, planned to close on the purchase prior to January 1, 2018, and actually completed the purchase prior to April 1, 2018. If you qualify for the exception, the mortgage interest deduction limit is still the first $1 million of indebtedness.

Limit On Home Equity Loans Or Lines Of Credit

Interest paid on home equity loans or lines of credit are only deductible to the extent the funds were used to buy, build, or improve the same home that secures the loan.

What Is Reported On Form 1098?

The Form 1098 reports information about your outstanding mortgage loan. The first few boxes are for the lender’s name, address, and Taxpayer Identification Number (TIN). The following boxes are for the borrower’s TIN, name, and address. The TIN is, in most instances, an Employer Identification Number (EIN) for a business and a Social Security Number (SSN) for an individual. However, there are exceptions.

Account Number

The account number is required if you have a payer/borrower who has multiple accounts and for whom you are filing more than one Form 1098. Although not required, the IRS encourages you to enter the account number on all Form 1098 submissions.

Box 1. Mortgage Interest Received From Payer(s)/Borrower(s)

The first box is how much mortgage interest you paid to your lender during the calendar year. Beware, if you prepay interest in the calendar year that accrues in full by January 15 of the subsequent year, the amount may be included in box 1. However, it cannot be deducted in the calendar year paid. You will have to remove the prepaid interest from the full amount listed in box 1.

Box 2. Outstanding Mortgage Principal

The second box is your outstanding mortgage principal, or amount owed, as of January 1 of the calendar year reported on the tax form. If your loan originated in the calendar year, it shows the principal as of the origination date.

Box 3. Mortgage Origination Date

The third box lists the date your loan was funded. Typically, it is the closing date when you signed your mortgage documents.

Box 4. Refund of Overpaid Interest

If you overpaid interest in a prior year, you may see an amount in box 4. You cannot deduct this amount. You may need to include part or all of the amount in box 4 as “Other Income” on Schedule 1, Additional Income and Adjustments to Income, of the Form 1040. You do not need to amend the prior year 1040.

Box 5. Mortgage Insurance Premiums

Box 5 reports mortgage insurance premiums you paid during the calendar year. Mortgage insurance premiums are amounts you pay for qualified mortgage insurance. These can be treated as home mortgage interest for insurance contracts issued after 2006. However, there is an income cap. If your AGI is above $100,000 ($50,000 if married filing separately), your mortgage insurance premium deduction is reduced, and the deduction is completely phased out for AGI above $109,000 ($54,500 if married filing separately).

Box 6. Points Paid on Purchase of Principal Residence

Box 6 reports points you paid during the year for the purchase of your principal residence. It only includes points that are required to be reported to you. Typically, points reported to you are fully deductible. Not all points you paid are reportable to you, and it is possible that other points you paid are still deductible.

Box 7. Address of Property Securing Mortgage

If your address is the same as the address of the property securing the mortgage, box 7 will be checked.

Box 8. Address or Description of Property Securing Mortgage

Box 8 includes either the address of the property or a description of the property. If the property has no address, as is often the case with empty lots prior to construction, the description should include the property’s jurisdiction and the property’s Assessor Parcel Number (APN).

Box 9. Number of Mortgaged Properties

If you have multiple properties securing the loan, box 9 will include the number of properties. If only one property secures your loan, the box may be blank.

Box 10. Other

Box 10 may include details from your lending agency such as your real estate taxes or insurance paid from escrow.

Box 11. Mortgage Acquisition Date

If the lending agency acquired the mortgage in the calendar year, the date it was acquired is listed in box 11.