How Do I Get a Copy of My W2 Online?

Say goodbye to the past when the only choice you had was to wait for a paper W2. Today, there are several options to get your W2 online. Most employers work with payroll service companies that have secure online sites. Here, the employees can obtain their tax information throughout the year. Common platforms for W2 forms storage may contain data for several years. So, the problem of access to past documents is solved. If you’re asking, “How do I get a copy of my w2 online?” here’s how.

Get One From Your Employer

Your answer to “How do I get a copy of my w2 online?” may be as simple as asking your employer. The use of digital portals means that many employers allow you to access W2 forms online through the payroll portal. This change in availability has resulted in you being able to access and download your W2 from your employer’s website. But there may be a situation where you have changed your job or no longer have access to these systems. In that case, there are other ways you can use to get W2 online.

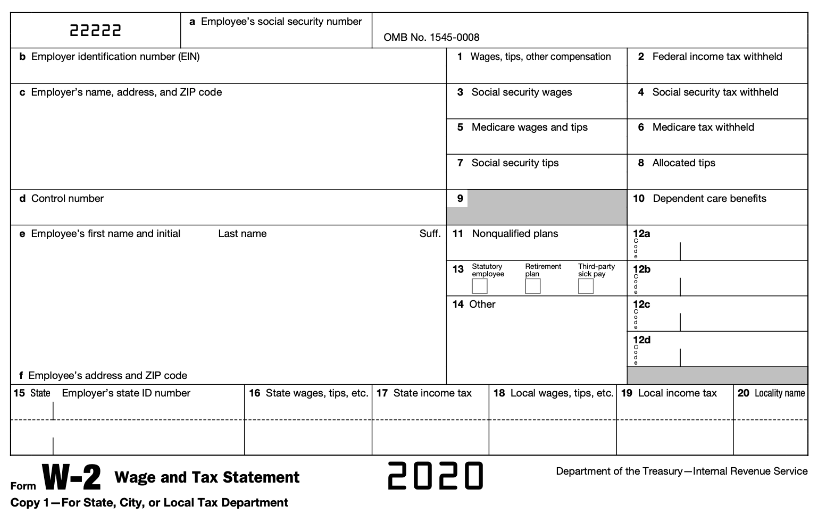

Online W2 Generator

In some circumstances, you may have problems with conventional ways, which is why an online W2 generator might help. These platforms help in developing tax-appropriate W2 forms depending on your details of pay details. There are scores of online W2 generators nowadays. With any reputable online W2 generator, your data is stored on their servers. And it can be accessed later to download your W-2s anytime. This saves time used to look for paper copies or worry about documents getting lost.

Besides, they also have other advantages. Any quality W2 generator is equipped with calculators. These are very useful in ensuring you get the correct tax withholdings and most other figures. This is important to reduce the chance of errors that will complicate your tax returns or affect your other affairs.

Use the IRS Online System

The IRS also offers a dependable way to retrieve past W-2 information. Through its “Get Transcript” service, you can access your wage and income transcript, which includes the data originally found on your W-2. Although it may take longer than using a generator, it remains a secure government resource for reviewing your official tax details.

Making the Most of Online W2 Resources

If you want to get the most out of using W2 online, you should:

Keep Digital Copies

Once your W2 is available, save copies in different secure locations. This includes places such as your devices, cloud storage or a password-protected folder. This ensures you always have access if you need the document again. With our system, you can always come back and generate W2 documents again whenever you need a clean copy.

Update Contact Information

Share your current email and phone number with your employer. Doing so ensures you receive timely updates about W2 availability and access instructions. And if you switch jobs or lose access to an employer portal, our W2 maker keeps you covered. You get fast, accurate W-2 documents anytime.

Verify Information Accuracy

Whether the form comes from an employer portal or you create W2 using our W2 generator, always review the information carefully. Our W2 form generator is built to reduce errors, helping you stay organized and confident during tax filing.

Securing your W2 online has never been more convenient. Employer portals, our online W2 generator, and IRS tools give you several dependable ways to access your information. However, when you need a clear, professional W-2 document instantly. No waiting, no delays, no stress. Our W2 generator is the fastest and easiest solution. Stay prepared. Stay organized. And let our tools help you handle tax season with confidence.