As an individual or employee, your pay stub document can help you out in various life situations Listed below are just a few

instances where you will need to show your pay stub or generated stub to prove your income regardless of your position in a company.

Paystub for Loan Application

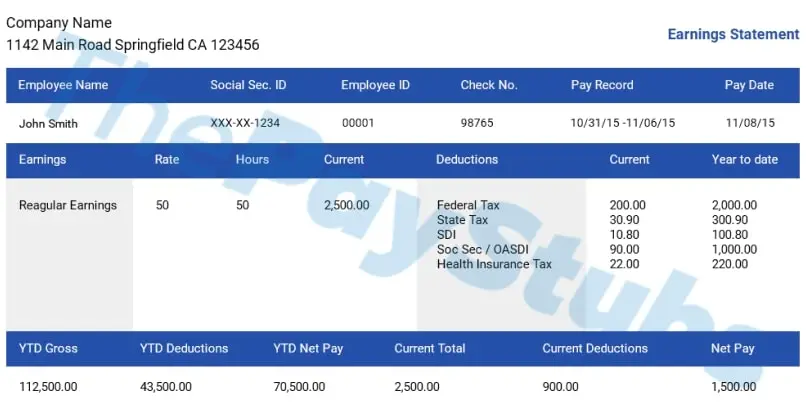

When you apply for a loan, whether it is for a company or a personal loan to buy a house or a car, the verdict will rely heavily

on your pay stub information. In these instances, how much money you've made over a period of time, and how often you get paid will

play a major role in whether or not they grant you the loan requested.

Paystub for Large Purchases

On a personal level, when you are about to make a large purchase, your check stub is needed so they can verify your identification

and your ability to pay. If you’re on a company payroll you’ll most likely need to show a few recent pay stubs and W2 forms.

If you are self-employed or an independent contractor your tax return forms could work for you or you can easily create a pay stub

instantly using a pay stub generator today!

Paystub for Renting an Apartment

You found the perfect apartment or office space after months of looking. Renting in itself requires you to present a few recent check

stubs as well as some other personal identification documents. It's best to ask your employer or generate pay stubs for yourself.

Paystub for Compensation and Claims

A check stub is advantageous to you in the event that an employee suffers an injury and needs to file for worker's compensation.

Workers’ compensation laws are in place to protect employees. These laws vary by state. Pay stubs documents help to verify how much

an employee would have been making had they not had the unfortunate accident.

Paystub for Tax Filing

In order for the company or the individual to properly file their tax return documents for the year and determine the taxes paid,

they need to have the required documents in place. That refers mainly to all the necessary paycheck stubs.

Always make sure that you are aware and compliant with the current tax laws. Reasonably you could also use a paystub generator to

help you out. It only takes a few minutes.

Some other useful use cases of pay stubs to be used as proof of income are as follows.

- Paystub for Self Employed/Freelancers

- Paystub for Small Businesses

- Paystub for Buying a House/Mortgage

- Paystub for Drivers & Dispatchers

- Paystub for Independent Contractors

- Paystub for Disability

- Paystub for Visa Application