Filing Taxes Without a W-2: Can I File Taxes With My Last Pay Stub?

Tax season is often one of the most stressful periods of the year, but it doesn't have to be. Most employees rely on their W-2 forms to file an income tax return. However, sometimes your employer may not provide your W-2 on time. This is why many then ask, "Can I file taxes with my last pay stub?" The answer is yes.

As long as you have a final pay stub, you can calculate your gross pay, net pay, and taxable wages. With these details, you can estimate your income and withholdings. Using your last pay stub can allow you to prepare a preliminary tax return and estimate your income tax.

If you don't have your final pay stub yet, you can quickly generate one. You can use a reliable pay stub generator to get the details you need. You can then file taxes online or by mail as an official substitute for the W-2 form.

This article explains how to use your pay stub to file your taxes. It includes everything you need to know about filing taxes with your last pay stub.

Understanding Your Pay Stub

Before asking, "Can I do my taxes with my last pay stub?' You must understand your pay stub. A pay stub is also called a check stub or paycheck stub. It is an official document that your employer provides for every pay period. It shows all your earnings, deductions and tax withholding. Your employer has to either provide your pay stub electronically or on paper.

While there is no federal requirement for employers to provide pay stubs, most states require them. Ensure you check your state's pay stub requirements to determine where you fall.

Your pay stubs typically include your:

Gross Pay

Gross pay refers to your total earnings before any deductions are made.

Tax Withholding

Your tax withholding refers to your federal, state, and local taxes withheld from your pay.

Tax Deductions

These refer to your pre-tax deductions and post-tax deductions. Your pre-tax deductions refer to your contributions to retirement accounts and health insurance. They also include other benefits that reduce your taxable wages. Post-tax deductions refer to your garnishments, union dues, or other deductions after taxes.

Net pay

Your net pay is the amount you take home after all deductions have been made.

Year-To-Date (YTD) Income

Year-to-date refers to the total income you receive in the current tax year.

A final pay stub or last paycheck stub helps if you want to file taxes without a W-2. Using this pay stub, you can calculate your taxable wages and prepare your income tax return.

Simply use our 123 Pay stub process to create your final pay stubs. You just have to fill in your employee details, preview and download your pay stubs instantly!

Can I File Taxes With My Last Pay Stub?

It's quite normal for employees to think, "Can you file taxes with your last pay stub?' or "Can you use your last paystub to file taxes?" You can actually use your final pay stubs. People mostly use their final pay stub for several reasons. Some of them include when they:

-

Their W-2 is missing

-

Relocate

-

Change jobs mid-year or towards the end of the year

With your final paystub, you can estimate your gross income and report taxable wages. You can also use it to determine if you are owed a refund. However, relying solely on your last pay stub is not advisable. It can be risky, as a pay stub doesn't have the detailed information you need to file taxes. They don't have an Employer Identification Number (EIN). They also don't have a precise income and tax category. A W-2 has a more detailed category. Without these, your return can be incomplete or wrong.

How To Do Taxes With Last Pay Stub

To file your taxes using your last pay stub, here's what to do:

1. Gather All Necessary Documents

The first thing to do while filing taxes with last pay stub is to gather your:

-

Gross pay, deductions, net pay and year-to-date

-

ID proof. This includes your Social Security number or prior tax returns

-

Any dependent information (if applicable)

-

Tax-saving investment documents. It could be your IRA contributions or pension proofs

-

Health insurance premiums

2. Estimate Your Annual Income

Your last paystub shows your gross pay for the period. Multiply this by the number of pay periods in the year to estimate your annual income. For example:

-

Monthly pay stub: Multiply by 12

-

Bi-weekly pay stub: Multiply by 24

Add any additional compensation or benefits that are not on your final pay stub. This ensures that your taxable wages are accurate.

3. Calculate Your Tax Deductions and Withholdings

Add up all deductions on the pay stub to estimate your tax liability. This includes your tax withholding amounts, like:

-

Federal Income Tax

-

State Income Tax

-

Social Security and Medicare

-

Any pre-tax contributions

4. Choose the Correct Tax Form

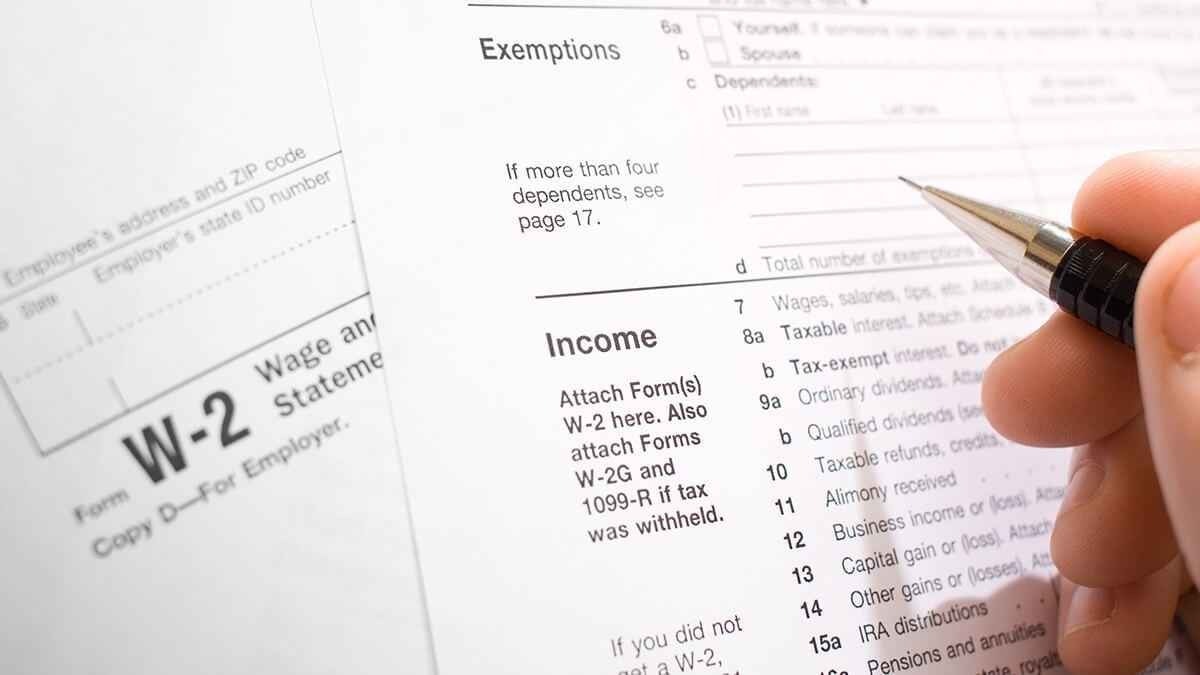

While you may be using your last pay stub as an alternative, it's not a tax form. If you were making use of a tax form, you can use any of the following to file taxes:

-

Form W-2: Standard wage and tax statement

-

IRS Form 4852: Substitute for W-2 if missing. You'd have to file with this.

-

Form 1040: Individual tax return

-

Form 1040-X: Amended return if there are any errors

5. Complete the Tax Form Accurately

Make sure you're careful when filing taxes. If you make any mistakes, it can lead to audits or delays in refunds.

6. Submit Your Tax Return

You can now file your tax return with your information from your final pay stub. Make sure you go through all your details to ensure that they're accurate. They should match the information on your form. Also, try to keep copies of your pay stub and all tax documents.

Filing Online

One of the easiest methods is e-filing. An online tax preparation software can allow you to use your last paystub to estimate your gross income, taxable wages, and tax deductions. IRS Free File is available for taxpayers with adjusted gross income below a certain threshold. Currently, it's at $73,000. E-filing, however, is generally available to most taxpayers regardless of their income.

If your income exceeds this amount, you may need to prepare a preliminary tax return using your pay stub. You may also need it if you're filing for the first time. Then, you'll submit it via mail. This is especially relevant if you are relying solely on your final pay stub or last paycheck stub.

Filing With IRS Form 4852

When your W-2 is missing or delayed, the IRS allows taxpayers to use Form 4852. It is also known as a substitute W-2 form. Your last pay stub will provide all the necessary details to file your taxes accurately.

While filing a Form 4852, you must also inform the IRS. Make sure you explain your efforts to obtain your late W-2. Then, attach Form 4582 to your tax return. Once you've done this, you can submit your tax return either electronically or by mail.

If your copy or sample of W-2 arrives later and it's different from your final paystub, you may need to amend your tax return. You'd have to use a Form 1040-X to amend.

How To Get Your W-2 Form

Your W-2 form shows how much you earned. It also shows the taxes that have been taken out of your paycheck over the year. The easiest way to get it is from your employer. They are legally required to provide it by January 31 of the following year.

Employers can send W-2s by mail, email, or through an online portal. If you don't receive yours on time, the IRS can also provide a copy. Although this usually takes longer. If you need a copy immediately, you can create a W-2 using our W-2 creator. This can help you get the information you need quickly.

Bottom Line

One of the things in life that is certain is taxes. Over a third of Americans file their own taxes, and none of them enjoy doing it. With these steps, filing taxes with your last pay stub can be a simple and quick process. It can help you process your refund or report taxes owed accurately during tax season.

You can decide to make the process even easier. Create your pay stubs with our pay stub maker. This way, you have all the information you need and can file your taxes easily.