What Does a W-2 Income Statement Look Like?

Looking at a W-2 income statement for the first time can feel overwhelming. A W-2 form appears as a compact, multi-copy tax form packed with numbered boxes and lettered fields. But the W-2 is simply a standardized way for your employer to report your employee’s income and taxes withheld.

It is different from a paystub, which specifically shows the details of your earnings. The W-2 income statement includes your annual gross wages, taxable wages and details of your income taxes. You find details, such as federal tax, state income tax, and local income tax withheld, on it. Employers send copies to you, the Social Security Administration, and the Internal Revenue Service.

It ensures accurate posting of your retirement plan or other employer contributions. This guide walks through what is included and how to read each section. It also explains how federal income tax withholding, Social Security tax withheld, Medicare tax withheld, and state taxes withheld appear on the form.

- What Is a W-2 Income Statement?

- What Is Included on a W-2 Income Statement?

- What Does a W2 Look Like?

- Breaking Down the Numbers: Boxes 1 to 20

- How To Correct a W-2 Form

- Social Security Tax For Businesses On The W-2 Form

- Can I File for Both W-2 & 1099?

- What If You Don’t Receive Your W-2?

- How To Fill Form W-2 for EITC and Child Tax Credit

- Wrapping up

What Is a W-2 Income Statement?

It’s a breakdown of your wage and tax statement. You need it to file your federal income tax return correctly. The Form W-2 summarizes how much you earned and how much your employer withheld in taxes for a tax year. This covers employees’ income, taxes withheld, and employer contributions. Basically, the W-2 income statement, also knows as the Form W-2 (Wage and Tax Statement) reports the wages you earned.

The W-2 form is essentially an official tax form recognized by the Internal Revenue Service (IRS). It's needed to calculate the accurate federal income tax withheld. Form W-2 is used to ensure employers and employees report accurate and reliable wages for Social Security and Medicare taxes.

On the form, you'll find details of taxes withheld, as well as federal and state returns. Employers must provide this form for each employee, along with a copy for the Social Security Administration and the IRS.

What Is Included on a W-2 Income Statement?

Here's what you'll find on a W-2:

-

Gross Wages

-

Federal Income Tax Withholding

-

Social Security Wages

-

Social Security Tax Withheld

-

Medicare Wages

-

Medicare Tax Withheld

It contains the employer's details, the employee’s Social Security number, and retirement contribution codes. These entries combine to show your taxable income and taxable wages for the year. Each field represents the employee’s income before payroll deductions, but after certain pre-tax deductions are applied. These include health insurance premiums or retirement plan contributions.

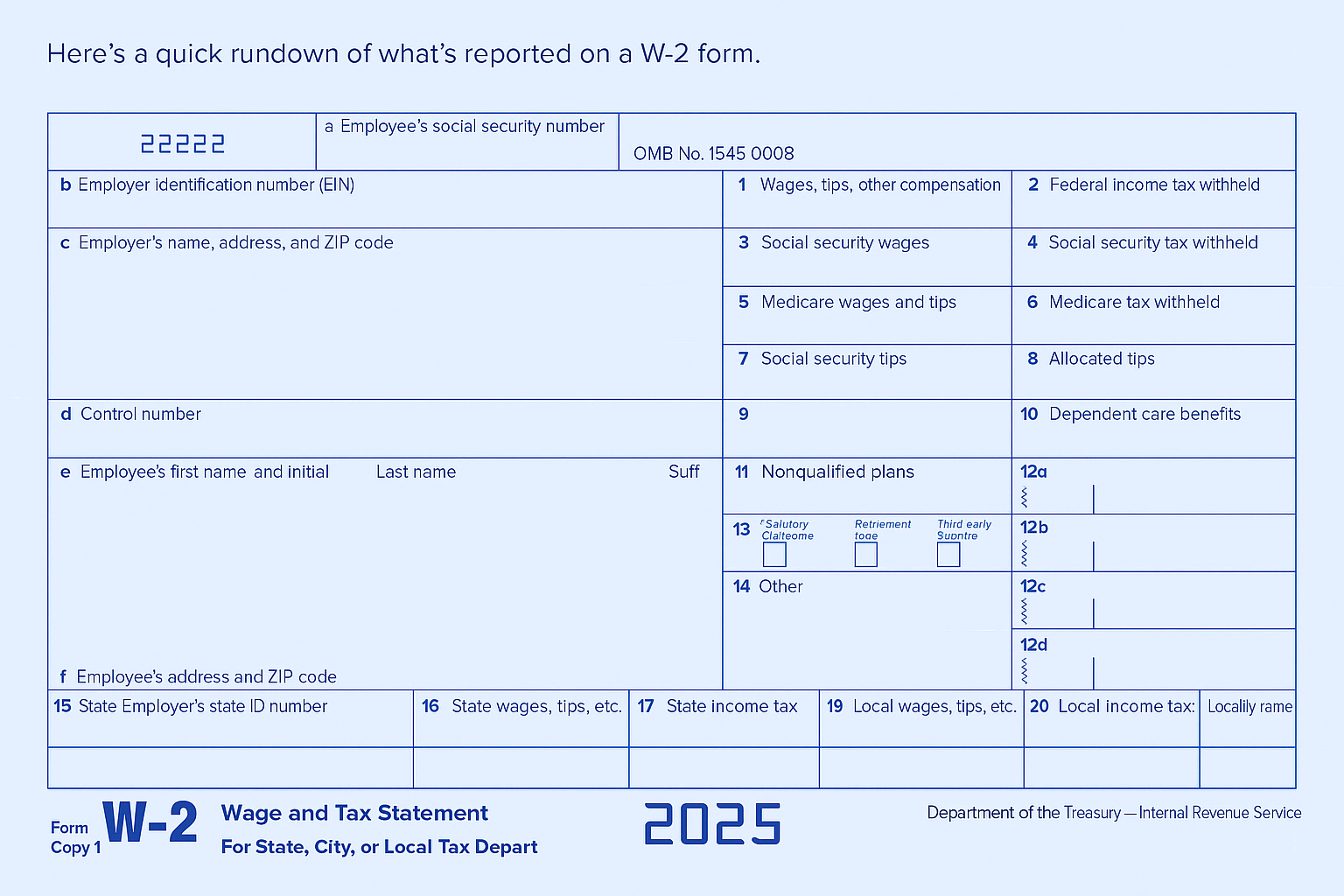

What Does a W2 Look Like?

When reviewing your Form W-2, you’ll usually see copies of the wage and tax statement, including employee, employer, and state copies. The top area contains identifying information:

-

your name and address

-

employee’s Social Security number (SSN)

-

employer’s name and address

-

employer’s employer identification number (EIN).

The employer’s identification number (EIN) identifies the business for federal tax purposes. It links your employee’s social security number to your wage record filed with the Social Security Administration. The information is detailed in boxes numbered 1 to 20 and lettered A to F for specific fields. Boxes A to F contain identification details.

Breaking Down the Numbers: Boxes 1 to 20

The information on a W-2 form is detailed in boxes numbered 1 to 20. Each of these boxes focuses on specific details:

Box 1: Taxable Income, Social Security and Medicare taxes

This shows the amount of your pay that's subject to federal income tax after allowable pre-tax deductions. Deductions like retirement plan contributions, insurance premiums, or health savings accounts may apply. However, some pre-tax deductions lower the Box 1 amount, but not the Social Security or Medicare wage bases.

These help calculate total federal income tax, Social Security tax withheld, and Medicare tax withheld. They show the employer and the employee contributions toward Social Security and Medicare taxes.

Box 2: Federal Income Tax Withholding

This is the total federal income tax withheld during the year. It's the amount credited toward your final federal tax liability for the year. It may lead to a refund if your taxes withheld exceed your actual income taxes owed.

Boxes 3 and 5: Wages Subject To Payroll Taxes

Box 3 lists Social Security wages, and Box 5 lists Medicare wages. These are the bases used to compute Social Security tax and Medicare tax, respectively. Social Security wages have an annual cap, while Medicare wages do not. This means earnings above that limit are not subject to additional Social Security taxes. An additional 0.9% Medicare tax may apply if your income exceeds a certain threshold.

Boxes 4 and 6: Taxes Withheld

Box 4 shows the Social Security tax withheld. Box 6 shows the Medicare tax withheld. These amounts are the payroll taxes paid on your behalf and withheld from your pay. Keeping these details accurate would protect you from a tax fraud situation.

Boxes 7 to 10: Tips, Dependent Care Benefits and Codes

Boxes 7 to 10 on your W-2 record special compensation. These could be tip income or employer-sponsored non-elective payments. Box 10 focuses on dependent care benefits, which are provided under a plan by an employer.

These sections of your W-2 form give more clarity on total employee compensation. They show how tips or dependent care assistance affect your overall taxable wages. It determines whether or not you are eligible for some federal tax deductions and credits.

Boxes 11 To 12: Deferred Compensation Plan And Medicaid Waiver Payments

Box 11 shows distributions or amounts from nonqualified deferred compensation (NQDC) plans. It also includes other types of employer retirement plans. These amounts are usually included to prevent the occurrence of double taxation if you later get payments from the same plan.

Box 12 uses letter codes to show amounts for HSA contributions, 401(k) deferrals, adoption benefits, and more. Each code has specific tax consequences, so check the W-2 instructions or ask payroll if a code is unclear.

This box is used to report different types of benefits, employer contributions, and compensation. It can also include any salary reduction agreements, employer-sponsored health coverage, and retirement plan contributions.

Box 13 and Box 14: Retirement Plan, Statutory Employees and Employer Notes

Box 13 contains checkboxes that tell you whether you participated in a retirement plan. It also specifies whether you were a statutory employee or whether you received third-party sick pay. The retirement checkbox does not show contribution amounts. But it can affect eligibility for certain tax deductions or credits.

Box 14 is reserved for employer-specific information that doesn't fit elsewhere on the Form W-2. Employers often use it to report things like union dues, state disability insurance, or health insurance costs. Because Box 14 entries vary by employer and state, ask payroll for explanations of any unfamiliar items.

It can include additional details such as state disability insurance (SDI) taxes. It shows educational assistance payments or other employer contributions that affect taxable wages.

Boxes 15 to 20: Tax Form (State and Local Taxes)

Boxes 15 to 20 report state income tax, local income tax, and employer state ID numbers. If you moved during the year or worked in multiple states, the state boxes can include amounts for multiple jurisdictions. Some states also require reporting of state disability insurance taxes and other local payroll items.

These sections cover state income tax, local income tax, and any other state income taxes withheld during the year. Some states require reporting state disability insurance taxes or local tax authorities deductions.

Understanding your payroll taxes ensures that the proper taxes are paid and reported on your tax return. They also help you know the proper arrangement when you want to create w2 online.

How To Correct a W-2 Form

What happens when details on your W-2 form are incorrect? Your best line of action is to contact your employer or payroll department immediately. It's the responsibility of employers to turn in a corrected W-2 (W-2c).

You should, however, keep both the original and the corrected copy of your W-2 form for the record. If, for some reason, your employer refuses to make corrections to your W-2 form, reach out to the IRS.

A corrected Form W-2c would be needed to update all details on your W-2 form. This includes errors that relate to federal income tax withholding, Medicare wages, or taxable income. Make sure all details included on your W-2 form are correct and verified. Especially, Social Security wages and Medicare tax withheld.

Preparing a W-2 form and need supporting pay stubs? Generate accurate stubs that match year-to-date totals with our 123 Paystub process. Just 3 simple steps, and you're done.

Fraud, Mismatches, and Taxable Costs in W-2 Form

Because the IRS and SSA receive copies of every W-2, mismatches between reported wages and what you report on your tax return can trigger notices. Identity theft may appear as false W-2s submitted in your name and affect your federal income tax calculations.

Regularly review your Social Security Statement and SSA earnings. Record and report discrepancies promptly to the Social Security Administration and the IRS. Always cross-check your gross wages, taxable cost, and other compensation with your final paycheck stubs.

Doing so helps detect tax fraud. It ensures your Social Security and Medicare taxes are credited by the Social Security Administration.

Social Security Tax For Businesses On The W-2 Form

Businesses must file Copy A of Form W-2 and a Form W-3 transmittal with the Social Security Administration. The SSA uses the W-2 information to post your earnings to your Social Security record. The IRS and SSA publish filing rules and deadlines; employers who miss deadlines may face penalties.

Large employers and many filers are required to e-file. Check the SSA and IRS guidance for electronic filing thresholds and e-file requirements. Employers must file accurate payroll taxes and ensure taxes withheld align with what was reported on each W-2 form. This prevents discrepancies between Social Security and Medicare taxes. It also helps with federal income tax withholding totals.

Can I File for Both W-2 & 1099?

Employees receive a Form W-2, while independent contractors or freelancers receive 1099 forms. The W-2 form reports wages, tips, and the amounts withheld for taxes during the year. In contrast, a Form 1099 reports nonemployee compensation. You must report it yourself when filing your federal income tax and income tax return.

If you receive both types, you must include both when you file. The two forms are handled differently for payroll tax and reporting purposes. If you’re not sure whether you should have received a W-2 or a 1099, ask payroll or HR.

Misclassification can affect your tax withholdings, payroll tax obligations, and benefits. Employers who misclassify employees may face penalties, so it is worth clarifying sooner rather than later. Both forms influence your gross income, income taxes, and potential tax refund.

Your W-2 form details taxable wages. The 1099 highlights nonemployee compensation that is not subject to employer-paid payroll taxes.

What If You Don’t Receive Your W-2?

Employers are generally required to provide W-2s to employees by January 31. If you've not received your W-2 by mid-February, contact your employer. If the employer fails to provide the form, contact the IRS for assistance.

The IRS can intervene and advise on how to file your return using Form 4852. This is a substitute for Form W-2 if a W-2 is missing. Keep records of your pay stubs and communications in case you need to provide proof.

Missing forms can delay your tax return and earned income tax credit claims. Keep payroll deductions and health insurance premiums records ready if you must use Form 4852. Having accurate tax paid data ensures your taxable income is properly calculated.

How To Fill Form W-2 for EITC and Child Tax Credit

Many tax credits and calculations use your W-2 numbers. For example, eligibility for the earned income tax credit (EITC) relies on wages reported on your W-2. The child tax credit and other refundable credits similarly depend on wages and withholding reported on W-2s.

If W-2 figures are wrong, credit calculations can be affected, so correct the form as soon as possible. Tax preparation software and tax professionals import W-2 box values to fill your Form 1040. Always double-check the imported numbers against your W-2 and year-end paystubs. This helps to avoid mismatches that can delay refunds.

Your child tax credit, earned income tax credit, and dependent care assistance program all depend on the wages reported in your W-2 form. Errors in federal income tax withholding or Medicare tax withheld can reduce your refund or delay processing.

Wrapping up

Your W-2 form is a primary wage and tax statement you need when preparing your tax return. With this breakdown, you know how a W-2 form works in reporting gross wages, taxable wages, and federal income tax withholding. It's beneficial to carefully review it and keep it safe for filing your taxes.

Having organized tax forms and payroll records prevents issues with income taxes. Keeping consistent payroll records makes it easier to prepare your year-end forms and verify your earnings. Use a W-2 creator to generate your form, confirm your annual income details and maintain accurate records. This makes filing simpler and more efficient.